Now that we've become better acquainted,

how can we help you achieve your goals and dreams?

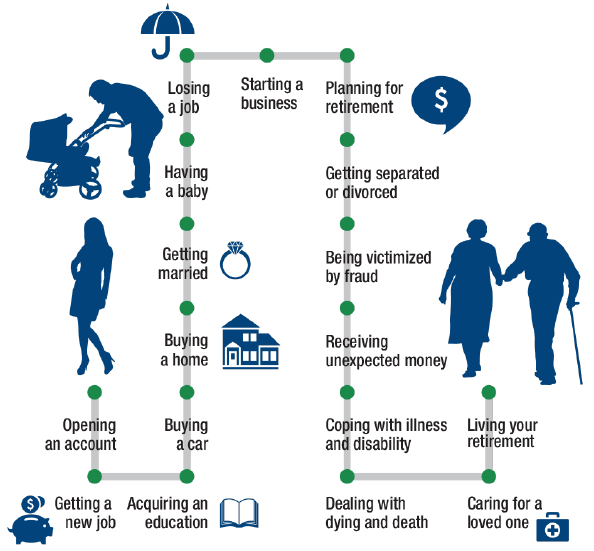

We are focused on helping you achieve freedom and choice at all stages of life. To do this, we use a collaborative planning process, which is based on the four cornerstones of financial security. What's your current stage?

“Society grows great when old men plant trees whose shade they know they shall never sit in.”

-Greek Proverb

Early Career

Starting early gives you the greatest opportunity to create your nest egg. You're working hard for your money - with the assistance of a financial planner, you can learn how to maximize growth. Let's begin by creating a financial security plan.

Protect your mortgage or another large loan with term life insurance; disability and critical illness insurance offer alternatives if you die too soon, become disabled or suffer a critical illness along the way.

If your employer doesn't offer a group benefits plan, investing in additional health and dental coverage can provide options for your protection.

“As a young person today, financial planning is scary. Everyone is telling you what you should do with your money and everyone's story is different. Sitting down with Al, he asked what I want for my life, then recommended financial planning strategies. Unlike other advisors, Al is willing to help you put together a custom solution and answer all your questions. He strongly encourages young people to do research instead of investing blindly, and is willing to support your financial education along the way. Now I'm confident that my money is safe and my future secure.”

-Natasha

Investment products for Early Career

Tax-Free Savings Account (TFSA)

A tax-free savings account (TFSA) is a flexible savings account that can help Canadians meet their short

and long-term savings goals. The growth within your TFSA is tax-free, unlike a non-registered plan where you are taxed

on the growth and interest earned.

To find out more information on TFSA’s and the contribution limits, please visit: https://www.canadalife.com/investing-saving/saving/tax-free-saving-account-tfsa.html

To find out more information on TFSA’s and the contribution limits, please visit: https://www.canadalife.com/investing-saving/saving/tax-free-saving-account-tfsa.html

Insurance for Early Career

Participating Life Insurance

Participating life insurance will provide coverage for life. It's simple: keep paying the required premiums and you'll

always be insured. Money made available through participating life insurance can be paid to your named beneficiaries - tax free - when you die,

potentially making the process of settling your estate much easier for your loved ones.

Finally, the cash value of your participating life insurance policy can grow tax advantaged over time. Overall, a participating life insurance policy can help protect you and your family while having access to cash values during your lifetime.

Finally, the cash value of your participating life insurance policy can grow tax advantaged over time. Overall, a participating life insurance policy can help protect you and your family while having access to cash values during your lifetime.

(705)-721-0450

(705)-721-0450

officeadmin@ajwep.ca

officeadmin@ajwep.ca  Al Jones on Facebook

Al Jones on Facebook  LinkedIn

LinkedIn